The Most Popular Health Insurance in Germany

Table of Contents

Which is the best health insurance in Germany?

Techniker Krankenkasse Munich

Location

Elisenstraße 3,

80335 München,

Germany

Location

TK Health Insurance English

Use the Free TK App to digitally submit your sick note

Access to Health Records in TK-Safe

Recieve mail securely with TK Mailbox

Earn discounts and rewards with TK Fitness program

If you are sick and can’t get to the doctor use TK-Doc to contact the TK Health centre via video call or chat

TK-Appointment Service will arrange doctors appointments

Participate in Digital Health Courses

Skin Cancer screeening from the age of 20

Public Health Insurance in Germany

Public health insurance in Germany is a great option for expats and foreigners who are looking for the cheapest health insurance in Germany that covers all their needs. If you are looking for statutory health insurance, then the Techniker Krankenkasse (TK) is a great choice. TK insurance covers medical services, dental check ups and it’s one of the most popular health insurance providers in Germany. Let’s take a closer look at what TK insurance Munich has to offer, and we’ll explain why it’s such a popular choice among expats and foreigners.

Who needs German health insurance?

Germany has a compulsory health insurance system, which means that everyone who lives and works in the country must have health insurance. This includes expats from other EU countries as well as those from outside the EU. There are a few exceptions to this rule, such as diplomats and other official government representatives, but for the most part, everyone must have expat health insurance in Germany.

Krankenkasse English

-

Contact the English speaking team at Techniker Krankenkasse

-

Learn how to Video Call your doctor

-

Learn how to send and receive digital prescriptions

-

Submit your sick note online

-

Arrange your 1 on 1 call with Florian and Leon to have your questions answered

Florian Metzulat

Leon Flatzek

German Statutory Health Insurance for Foreigners

German Statutory Health Insurance for Foreigners, also known as expat health insurance, is a type of health insurance that is specifically designed for foreigners living in Germany. It is mandatory for all expats who are employed in Germany and is often offered by employers as part of their benefits package. Expat health insurance provides coverage for all medically necessary treatments, including hospital stays, doctor’s visits, prescriptions, and more.

In addition, expat health insurance in Germany typically includes coverage for emergency medical evacuation and repatriation. For expats who are not employed in Germany, there are a number of private health insurance options available. German Statutory Health Insurance for Foreigners is an important part of staying healthy and safe while living in Germany.

How does statutory health insurance work?

Statutory health insurance in Munich, Germany is a bit different than what you may be used to in your home country. In Germany, there are over 100 statutory health insurance providers, and each one is required to offer the same basic level of coverage. This means that you can choose whichever provider you like, based on factors such as cost, coverage, location, and more. Once you have selected a provider, you will need to pay your monthly premiums in order to maintain your coverage.

In some cases, your employer may cover the health insurance costs of your insurance premiums. If not, you will need to pay them yourself. Most providers offer a basic package of TK benefits, which must include things like inpatient and outpatient care, preventive care, vaccinations, and maternity care. Some providers also offer same benefits for an extra cost. In general, people are happy with the statutory health insurance system in Germany because it ensures that everyone has access to quality medical care.

How much is German Health Insurance?

Calculate how much your health insurance will cost as an employee or a self-employed person.

What to Consider while Choosing the Best Health Insurance in Germany

There are a few things to keep in mind while choosing the best health insurance in Germany.

The type of insurance you need

There are different types of health insurance available in Germany, such as private health insurance, expat health insurance, and statutory health insurance. Make sure to select the type of insurance that is best for your needs

Your budget

Health insurance can be expensive, so it’s important to find a plan that fits your budget. Compare the cost of premiums, deductibles, and co-pays before you make a decision

Your coverage needs

Make sure to choose a plan that covers the things that are important to you. For example, if you have a chronic illness, you will want to make sure that your insurance plan covers the cost of your medication

The reputation of the company

Do some research on the private and public health insurance companies that are available in Germany. Make sure to read reviews and compare TK customers satisfaction ratings before you make a decision

The language

If you don’t speak German, it’s important to choose a health insurance company that offers customer service in English or in your language. This will make it easier to communicate with your insurance company if you have any questions or problems

The location

If you plan on living in a specific city or region in Germany, make sure to choose an insurance company that has offices in that area and also has an online presence like TK website. This will make it easier to get the care you need when you need it.

Why do Expats in Germany Choose Techniker Krankenkasse?

Techniker Krankenkasse is one of the largest and most popular health insurance companies in Germany. They offer a wide range of benefits, including excellent customer service, a large network of doctors and hospitals, and competitive prices. In addition, they offer a number of extras, such as dental coverage and travel insurance.

Who can get TK health insurance in Munich, Germany?

Techniker Krankenkasse is open to everyone who lives or works in Germany. This includes international students or foreign students, self-employed workers, retirees, and expats. In order to get germany expat health insurance, you will need to fill out an application and provide proof of your residency or employment in Germany.

TK public health insurance benefits

All TK health insurance plans include the following benefits:

-

Inpatient and outpatient care

This includes things like doctor’s visits, hospital stays, surgery, and tests

-

Preventive care

This includes prenatal care, delivery, and postnatal care

-

Maternity care

This includes prenatal care, delivery, and postnatal care

-

Dental care

This includes prenatal care, delivery, and postnatal care

-

Travel insurance

This covers you in case you need medical care while you’re traveling outside of Germany

-

Vision care

This covers things like routine eye exams and glasses or contact lenses

-

Chiropractic care

This covers things like routine chiropractic adjustments such as spine, neck, and joint manipulation.

How to contact TK health insurance in Germany

If you have any questions about TK health insurance in Munich, you can contact their English speaking customer service team by clicking here.

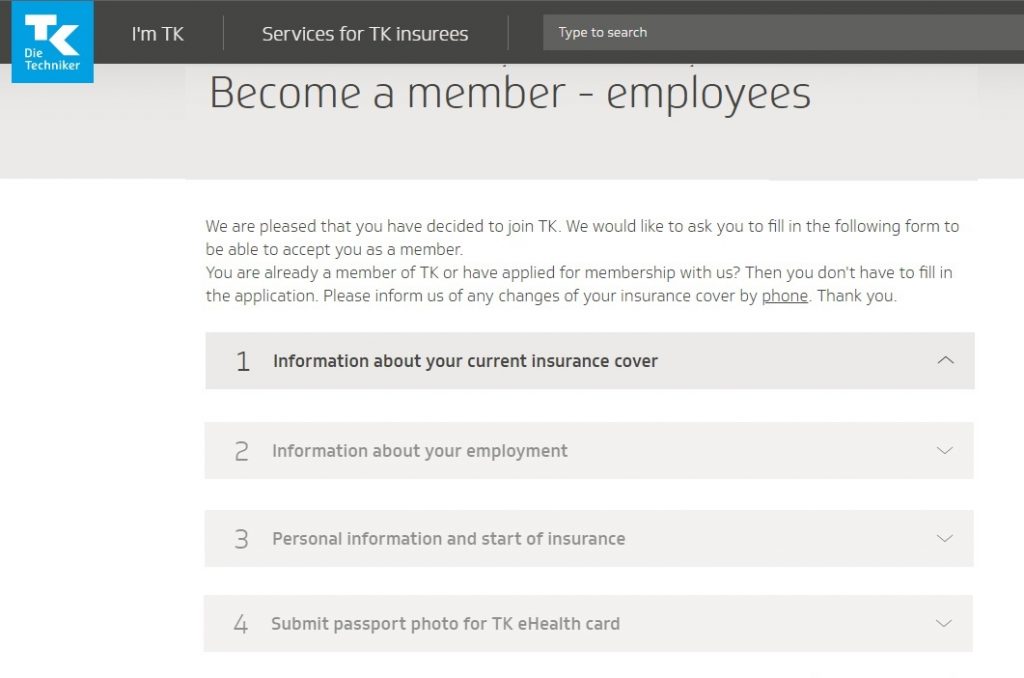

How to Apply for Expat Health Insurance in Germany

If you’re an expat living in Germany, you may be required to have Germany expat health insurance. Health insurance is mandatory for all residents of Germany, regardless of their nationality or employment status. You can apply for health insurance through a number of different providers, such as private insurers, statutory health insurers, and expat health insurers .

The application process for health insurance in Germany is relatively simple. You will need to fill out an application form and provide some basic information about yourself, such as your name, address, date of birth, and nationality. You may also be required to provide proof of your residency or employment in Germany. Once you have submitted your application, you will usually receive a insurance certificateb within a few days.

Health Insurance Cost Calculator

You can use this health insurance cost calculator to estimate the cost of health insurance in Germany. The calculator will take into account a number of factors, including your age, location, and whether you smoke.

Why you should choose Techniker Krankenkasse for Health Insurance

TK Electronic Health Card

The TK electronic health card is different from European Health Insurance Card as it contains your passport photo and signature.

With the TK health card, doctors can settle the fees for services with the health insurance fund.

FAQs

No, TK is a statutory health insurance provider. This means that it is regulated by the government and must offer certain benefits to all of its members.

Yes, all residents of Germany are required to have health insurance. This includes expats, students, and workers.

No, there are a number of cheaper health insurance providers in Germany. However, TK is known for its excellent customer service and wide range of benefits.

The cost of health insurance in Germany will vary depending on a number of factors, including your age, location, and whether you smoke. You can use the health insurance cost calculator to estimate the cost of your insurance.

If you are unemployed, you may be eligible for government-funded health insurance. You can also apply for private health insurance or expat health insurance.

If you are working for an employer who provides health insurance, then you are automatically enrolled in the plan and do not need to take any further action. If you are a student and receive health insurance through your school, then make sure to bring your international student ID card with you when you go to the doctor or hospital. If you choose to purchase private health insurance, then compare different plans to find the best one for your needs and budget.

TK costs are based on what you make each month. Normally, 15.3% of your gross monthly income will go towards TK payments. For example, if someone makes 2000 euros per month, they can expect to spend 306 euros on TK that same month. The 15.3% fee is made up of a general 14.6% fee and an additional 0.7% TK fee. The maximum monthly contribution is 694.50 euros/month for anyone earning more than 4537.50 each month.